5 Areas of Wealth Transfer

Start with a Discovery Meeting

What are you currently doing to prepare for your financial future?

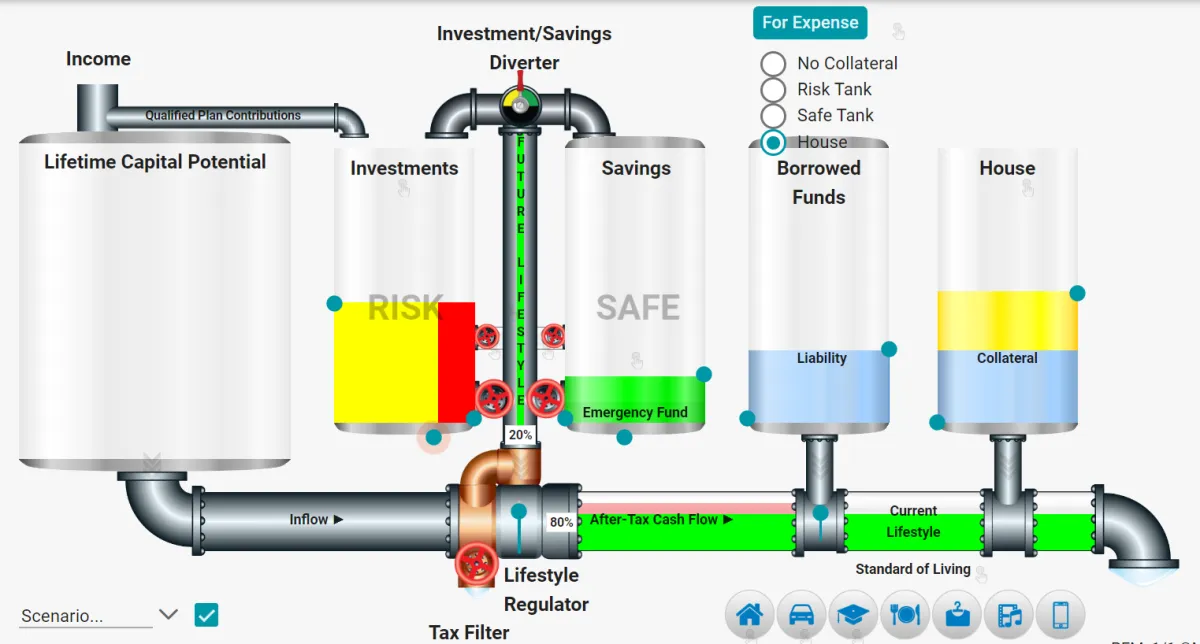

Introduction to the Personal Economic Model.

Inefficiencies/Wealth Transfers

There are 2 ways to fill up a bucket that has got holes in it. First, you could plug the holes, then the bucket will fill up even if the flow is a trickle. Second, you could pour more in. While you may want to pour more in, it doesn't make sense to until you've plugged the holes. Our second step in working together will be to see if we can find areas where you may be more efficient without the need to reduce your current lifestyle.

Part 1: Personal Economic Model

The Personal Economic Model will give you a visual picture of how money flows and allow us to communicate at the highest level. The PEM is designed to help you visualize your money from perhaps a different perspective than you have ever seen before and may help you to increase the overall efficiency of how you manage your cash flow.

Part 2: Inefficiencies/ Wealth Transfers

There may be more to be gained by avoiding losing strategies than in picking winning ones.

Identify; then reduce or eliminate wealth transfers, this frees up money that can be added toward lifestyle and/or accumulation, with no additional out of pocket cost.

There are five major areas where most people are losing money unknowingly and unnecessarily:

How you pay for your house

How you fund your retirement accounts

How you pay taxes

How you pay for your children's education

How you pay for major capital purchases, like cars, weddings

By avoiding unnecessary transfers, dollars can be freed up and put towards a more secure and prosperous future for you and your family; while striving to live your most fulfilling life now.

Are you ready to take your first step to building a better financial future for your and your family?

Our Office

266 Pheasant Ridge Road

Lewisburg, PA 17837

Give us a Call

570 428 2161

Email us

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Registered representative offering securities through Cetera Advisor Networks LLC (doing insurance business in CA as CFGAN Insurance Agency LLC), member FINRA/SIPC. Cetera is under separate ownership from any other named entity. Advisory Services and Financial Planning offered through Vicus Capital, Inc. a Federally Registered Investment Advisor.

All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful.

This site is published for residents of the United States only. Registered Representatives of Cetera Advisor Networks LLC may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Not all of the products and services referenced on this site may be available in every state and through every representative listed. For additional information please contact the representative(s) listed on the site, visit the Cetera Advisor Networks LLC site at ceteraadvisornetworks.com

Important Disclosures and Form CRS | Business Continuity | www.ceteraadvisornetworks.com

Individuals affiliated with this broker/dealer firm are either Registered Representatives who offer only brokerage services and receive transaction-based compensation (commissions), Investment Adviser Representatives who offer only investment advisory services and receive fees based on assets, or both Registered Representatives and Investment Adviser Representatives, who can offer both types of service.

Cetera Advisor Networks LLC exclusively provides investment products and services through its representatives. Although Cetera does not provide tax or legal advice, or supervise tax, accounting or legal services, Cetera representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice.